mississippi state income tax calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you make 72500 a year living in the region of Mississippi USA you will be taxed 12147.

Income Tax Calculation Formula With If Statement In Excel

Enter your details to estimate your salary after tax.

. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. Our calculator has been specially developed. Your household income location filing status and number of personal exemptions.

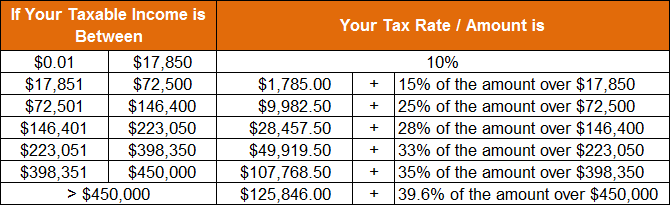

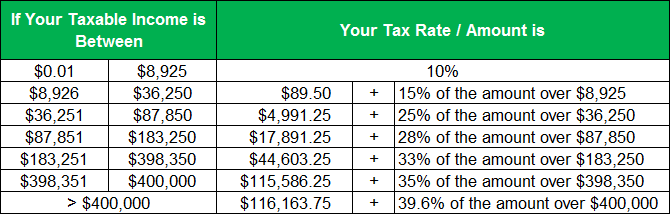

Below are forms for prior Tax Years starting with 2020. The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Married Filing Joint or Combined.

The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Mississippi State Tax Quick. Discover Helpful Information And Resources On Taxes From AARP.

Ad See How Long It Could Take Your 2021 State Tax Refund. Ad Bloomberg Tax Expert Analysis Your Comprehensive Mississippi Tax Information Resource. Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions.

Below is listed a chart of all the exemptions allowed for Mississippi Income Tax. Mississippi State Income Tax Forms for Tax Year 2021 Jan. This results in roughly 2520 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. Mississippi Hourly Paycheck Calculator. Mississippis SUI rates range from 0 to 54.

Mississippi state tax 3085. Calculating your Mississippi state income tax is similar to the steps we listed on our Federal paycheck calculator. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

Mississippi Income Tax Calculator 2021. Figure out your filing status. 2300 exactly 12 of the 4600.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions. Mississippi Salary Calculator for 2022. Details of the personal income tax rates used in the 2022 Mississippi.

Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. All other income tax returns.

Mississippi Salary Paycheck Calculator. Mississippi Salary Tax Calculator for the Tax Year 202223. Although this is the case keep in.

Mississippi Income Tax Forms. Use our income tax calculator to find out what your take home pay will be in Mississippi for the tax year. The rates range from 0-5 and are based on the taxpayers adjusted gross income AGI.

Your average tax rate is. Ad Automate Standardize Taxability on Sales and Purchase Transactions. The 2022 state personal income tax brackets are updated from the Mississippi and Tax Foundation data.

Mississippi tax forms are sourced from the Mississippi income tax forms page and are updated on. Mississippi taxpayers keep in mind. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

If you are receiving a refund. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Details on how to only prepare and print a Mississippi 2021 Tax Return.

The taxable wage base in 2022 is 14000 for each employee. Filing 2000000 of earnings will result in 28500 of your earnings being taxed as state tax calculation based on 2022 Mississippi State Tax Tables. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000.

The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in. The Mississippi Department of Revenue is responsible for publishing. Mississippi does allow certain deduction amounts depending upon your filing status.

The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. These back taxes forms can not longer be e-Filed. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA.

Integrate Vertex seamlessly to the systems you already use. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

The Mississippi tax calculator is updated for the 202223 tax year. Switch to Mississippi hourly calculator. As we discussed before Mississippi uses a graduated system to structure their state taxes.

Personal income tax is only a portion of your state tax liability. This Mississippi hourly paycheck calculator is perfect for those who are paid on an hourly basis. Taxpayer Access Point TAP Online access to your tax account is available through TAP.

How To Calculate Income Tax In Excel

Income Tax Calculation Formula With If Statement In Excel

Mississippi Tax Rate H R Block

2022 Income Tax Withholding Tables Changes Examples

How To Calculate Income Tax In Excel

Mississippi Paycheck Calculator Smartasset

Missouri Income Tax Rate And Brackets H R Block

Mississippi Income Tax Calculator Smartasset

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus

How To Calculate Income Tax In Excel

Mississippi Tax Rate H R Block

How To Create An Income Tax Calculator In Excel Youtube

Income Tax Calculator Estimate Your Refund In Seconds For Free